from The Seattle Times....Troublesome advanced engines for Boeing, Airbus jets

have disrupted airlines and shaken travelersBy DOMINIC GATES | 6:AM PDT — Friday, June 15, 2018 In 2014, Air New Zealand and Boeing showed off the first delivered 787-9 Dreamliner at Paine Field in Everett as finishing touches were put on the casing of a Rolls-Royce Trent 1000 engine.

In 2014, Air New Zealand and Boeing showed off the first delivered 787-9 Dreamliner at Paine Field in Everett as finishing touches were put on the casing of a Rolls-Royce Trent 1000 engine.

— Photograph: Mike Siegel/The Seattle Times.A SLEW OF TECHNICAL PROBLEMS with the three most advanced models of jet aircraft engines is widely disrupting operations at airlines, bleeding cash from the engine makers and grounding significant numbers of Airbus and Boeing jets.

The most difficult of the issues has this month left almost 50 Boeing 787 Dreamliners sold to some of the world's top airlines sitting powerless on the ground, waiting for engines before they can fly again.

And if the problem isn't contained, it could derail Boeing's plan to raise the 787 production rate next year.

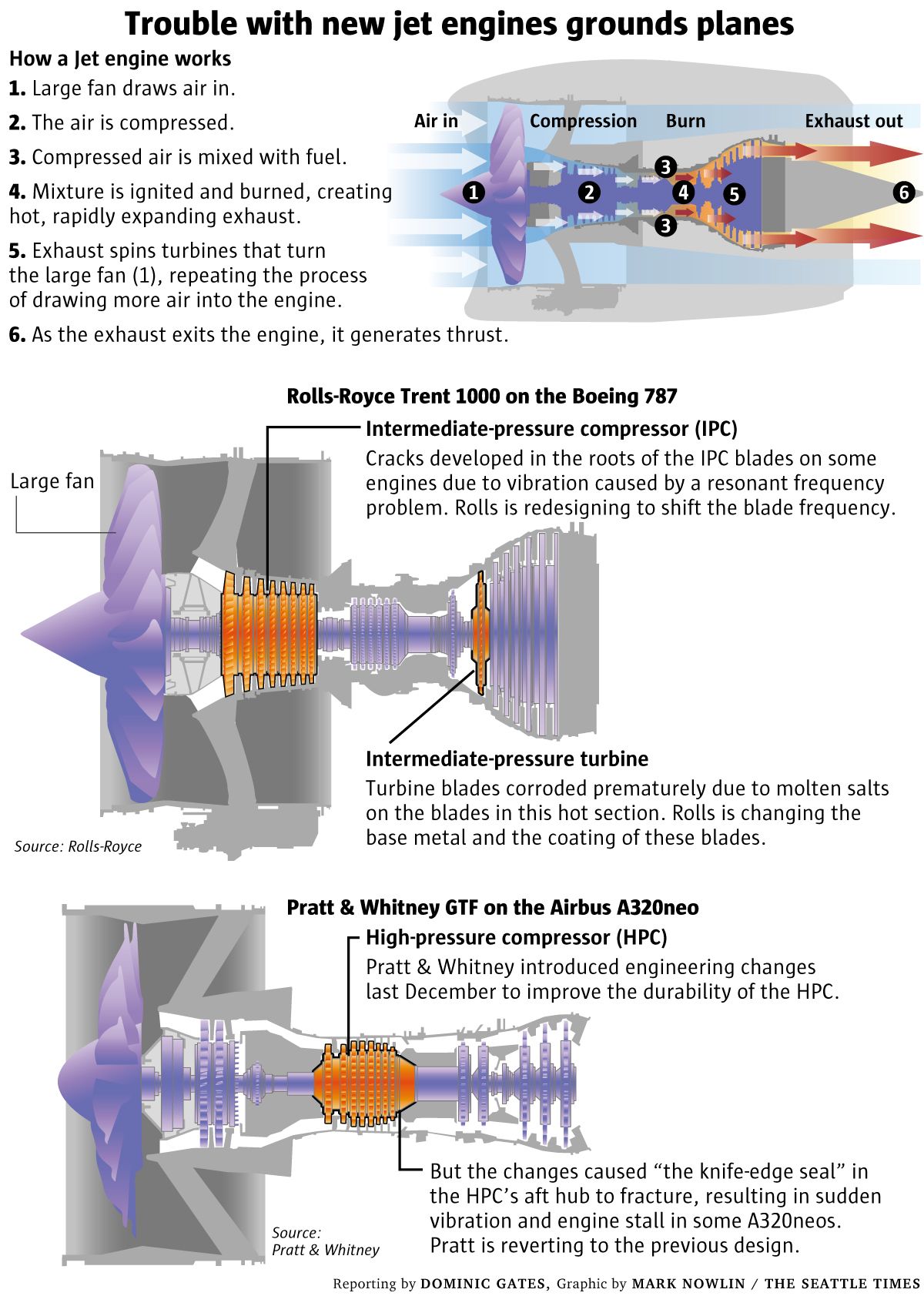

British engine manufacturer Rolls-Royce has been inspecting its Trent 1000 engines on the Dreamliners for cracked turbine blades deep inside, and taking off those with cracks for repair.

The number discovered to have problems has “outstripped our ability to support the customers with spare engines,” said Trent 1000 project director Gary Moore in an interview.

“We are causing a very disproportionate amount of disruption at this moment.”

Steve Udvar-Hazy, chairman of Air Lease Corporation and a leading figure in the airline world, said disruption from the grounded jets is compounded by airlines having to reroute some of the Dreamliners they can still fly.

Flights across the Pacific, in particular, can no longer fly normal routes because, in case of an engine emergency, safety agencies now limit Dreamliners powered by one of the Trent 1000 engine models under scrutiny to

flying no more than 2.3 hours from the nearest airport — down from 5.5 hours previously.

“It's having a huge impact. It affects a lot of the key 787 operators,” said Udvar-Hazy. “There's a lot of scrambling going on.”

No quick fixesThe impact won't be short term.

Rolls-Royce is returning the repaired engines to airlines with only a temporary fix. A permanent modification won't be available until the end of the year at the earliest.

“Those engines will have to come back to us when the final fix is available,” said Moore.

Meanwhile, repeated technical problems with another engine — Pratt & Whitney's Geared Turbofan (GTF), the innovative new design that will power close to half of the Airbus A320neo fleet — have caused Pratt to fall way behind in deliveries, leaving engineless planes to stack up on the ground at Airbus factories.

At a gathering of the world's top airline executives in Sydney this month, Guillaume Faury, the new president of Airbus Commercial Aircraft, said that by the end of June the European jetmaker will have about 100 otherwise completed A320neos sitting grounded without engines outside its final-assembly plants in Toulouse, France, and Hamburg, Germany.

“We have an industrial crisis to manage,” Faury told trade publication

Aviation Week.

In comparison, the problems with the third engine — CFM International's LEAP engine, which powers the rest of the Airbus A320neos and all of Boeing's 737 MAXs — are less severe.

Boeing says it's been able to minimize the impact on MAX deliveries. But CFM had to remove dozens of LEAP engines from A320neos for repair, and LEAP deliveries to Airbus are running up to six weeks behind schedule.

Problems emerge late

Problems emerge lateThese latest engines, all marvels of sophisticated engineering, incorporate significantly new technologies: new alloys in the Trent 1000, a gearbox to slow the fan speed in the GTF, ceramics in the hottest part of the LEAP.

All were certified as safe by the Federal Aviation Administration (FAA) and its European equivalent, the European Aviation Safety Agency (EASA).

And all three are powering the latest generation of fuel-efficient Airbus and Boeing aircraft where production rates are rising sharply to levels never before anticipated: heading up to 14 jets per month for the widebody 787, and to 60 jets per month and higher for the narrowbody 737 and A320 aircraft.

“The new technology aircraft bring tremendous economics and operating performance to the airlines, but they are only as good as the engines,” said Udvar-Hazy. “We have never seen this unprecedented number of aircraft scheduled to be produced at the very time when we have all these engine issues.”

Unfortunately, so-called “teething problems” with new technology may not show up until the engines have been used for several thousand hours in all kinds of climate conditions.

“The issue with engine certification is that there's really no substitute for in-service experience,” Hazy said.

FAA spokesman Les Dorr said the safety agency monitors newly certified engines after they enter service for issues “that were not evident in the certification phase.”

And when engine makers come up with fixes to such issues, they cannot be installed on airplanes until the FAA analyzes, tests and certifies the changes.

“Engine modifications undergo the same scrutiny … as original designs,” Dorr said.

Airline troubleThe public's belief in airplane and jet-engine safety is understandably shaken by terrifying accidents such as the April engine explosion on a Southwest Airlines 737 that killed a female passenger when shrapnel from the engine shattered the window by her seat, depressurizing the plane and partially sucking her out of the aircraft.

Yet that was the first U.S. airline-passenger fatality due to an accident in more than nine years, and the first in Southwest's history. The engine that exploded, the CFM-56, has been in service since 1997, has flown for some 350 million flight hours and has a reliability record second to none.

Statistically, flying is the safest form of modern travel.

Jet engines have become so immensely reliable that four-engine airliners are fading into the past. Planes with just two engines safely traverse vast expanses of oceans every day. If one engine fails in flight, those jets readily fly for hours on the remaining engine to the nearest airport.

And all the newest engines send critical performance data to the ground in real time while in the air, so any irregularities are quickly detected.

The latest engine issues have produced in-flight engine shutdowns and aborted take-offs but no incidents that put passengers at risk. So for the airlines, the risk is more to the reliable operation of the airplanes than their safety.

Still, even the potential for the flaws to affect both engines of a twin-engine plane while in flight was enough to spook safety regulators to issue directives restricting flights on both the Rolls and Pratt engines.

And the trouble created for the airlines, for Airbus and Boeing, and especially for the engine makers, is serious and very expensive.

To satisfy the safety regulators and mitigate the impact on airline operations, Rolls, Pratt and CFM are throwing engineering resources and money at the technical problems.

“It's a very painful thing for all of them,” said Udvar-Hazy.

On Friday, Rolls updated its projection of the cost of dealing with the Trent engine crisis to a total of almost $950 million.

787 engine flawThe latest hit to Rolls-Royce came when it was still dealing with the fallout from an earlier Trent 1000 technical problem: corroded turbine blades in the hot rear section of the engine.

After redesigning those blades with a new base metal and a new coating, retrofitting the engines in service is still ongoing.

The more recent, and now more pressing, problem showed up when cracks were found in the roots of the blades of the Intermediate-Pressure Compressor (IPC), behind the fan at the front of the engine.

Moore pointed to a design flaw: The vibrating frequency of the compressor blades resonated with the frequency of the engine at high thrust, magnifying the vibration to a level that over time caused the cracks to develop.

The immediate need was to inspect the susceptible engines — initially the “Package C” version of the Trent 1000, a total of 383 engines — and remove any with cracks for repair.

The problem intensified when fractured blades and excessive vibration led to several inflight engine shutdowns and aborted takeoffs.

In response, safety regulators gave Rolls-Royce until June 9 to complete an initial set of inspections on Package C engines that have clocked more than 300 flights, though all will have to be inspected eventually.

Two days after that deadline passed, Rolls-Royce announced that the problem had spread: It found cracks in the IPC blades in a small number of engines that are a different Trent 1000 variant, the “Package B” model.

That adds another 166 Dreamliner engines that must be inspected.

Technicians make adjustments to a Rolls-Royce Trent 1000 engine on an Air New Zealand 787 in 2014. — Photograph: Mike Siegel/The Seattle Times.Intense response

Technicians make adjustments to a Rolls-Royce Trent 1000 engine on an Air New Zealand 787 in 2014. — Photograph: Mike Siegel/The Seattle Times.Intense responseRolls-Royce must act fast or its rival GE, which also builds Dreamliner engines, will grab its market share.

Within a month of finding the original IPC problem, Rolls-Royce engineers developed and certified an ultrasonic inspection method to detect the invisible cracks in the interior of the blades without taking the engines off the wing.

It opened facilities in Singapore and the U.K. dedicated solely to those repairs — dismantling the engines, replacing the cracked blades, treating the remaining blades to close up any invisible micro-cracks, and applying a protective lubricant.

British Airways, Air New Zealand, Virgin Atlantic, Norwegian and LATAM Airlines of Chile were among the airlines forced to ground jets when engines were removed for repair with no replacements.

Willie Walsh, chief executive of British Airways parent IAG, said six of the airline's 26 Dreamliners are currently grounded, and he now expects he won't get all of those back in service until late July.

“I have no issue with Boeing, who have been proactive and supportive … I am however, very unhappy with Rolls-Royce,” Walsh said, via email. “They have yet to give us confidence that they are on top of the problem.”

British Airways and Virgin Atlantic leased Airbus A330 aircraft to fill the schedule gap. Air New Zealand leased two Boeing 777s to fill in. Norwegian leased a four-engine Airbus A340 gas-guzzler to fly its Paris-Los Angeles route.

Rolls-Royce hopes by year end to certify a permanent fix — a redesigned blade with tolerances tweaked to shift its resonant frequency.

Moore said Rolls-Royce engineers are now testing the first modified hardware in a development engine at a facility in Derby, U.K., to verify that “we have moved the blade’s frequency to a point where I no longer have concerns.”

A second test engine will be used to confirm that the engine's overall operation is unaffected by the change to the blades.

Next year, Rolls-Royce plans to gradually remove all those repaired engines once again to install the permanent modifications.

Meanwhile, Boeing deployed teams worldwide with Rolls-Royce to try to mitigate the disruption at affected airlines and tapped senior executive Keith Leverkuhn to work directly with Rolls-Royce.

“Keith and I talk every day,” said Moore.

Knife-edge sealFor Pratt & Whitney's new GTF engine,

developed starting in the early 2000s at a cost of more than $10 billion, the advance worry was that it might run into trouble with the engine's big technology innovation:

the gearbox that allows the fan to run slower and more efficiently.

It turns out the gearbox has operated smoothly with no issues. However, the GTF did run into a rash of other

“teething problems”.

Though Pratt developed fixes for all of them and the latest engines it's building are up to date with those fixes, GTF production has been hampered and delayed, and deliveries to Airbus were interrupted.

Spokeswoman Jenny Dervin said the latest problem arose after a batch of engineering changes were introduced last December to improve the durability of the High Pressure Compressor (HPC).

Instead, the changes caused “the knife-edge seal” in the HPC's aft hub to fracture, resulting in sudden vibration and engine stall in some A320neos. This led to several inflight engine shutdowns and aborted take-offs.

“By the end of January, we knew we'd have to recall the engines,” Dervin said.

Only 98 engines had been built with the defective seals — 43 in service and another 55 still at the Airbus final assembly plants.

In February, EASA issued an airworthiness directive prohibiting airlines from flying any plane that had the defect on both engines. India's air-safety regulator grounded planes having even one such engine.

By now, no GTF engines flying anywhere have the defective seal. For Pratt, what remains is to clear the backlog of engines to be delivered to Airbus.

Loss of a thin coatingFor CFM's LEAP engine, and specifically for Boeing's 737 MAX, the introduction into service has been smoother. On the MAX and the Airbus A320neo, LEAP engines are now powering 342 aircraft with 56 airlines.

However, the LEAP was hit by one technical glitch related to a key innovation: a ceramic composite lining that shrouds the hottest part of the engine, the first rotor of the High-Pressure Turbine just aft of the fuel combustion chamber.

This ceramic material requires a thin protective coating. Rick Lowden, a research scientist at Oak Ridge National Laboratory, which developed the ceramic material, said that without such a coating, moisture in the gas emerging from the combustor will oxidize the ceramics and gradually “eat it away.”

CFM spokeswoman Jamie Jewell said engineers found a “premature loss” of this coating in service.

“This is not a safety or operational issue,” Jewell said, adding that the problem hasn't caused any incidents during thousands of hours of engine tests and more than a million engine in-service flight hours.

To fix it, CFM designed a new coating. That's being introduced into full-rate production for aircraft deliveries starting this month.

And about 60 LEAP engines were removed from A320neos for modification, none from 737 MAXs.

“Each of those removals were scheduled in advance and we are supporting the removals with around 70 spare engines,” Jewell said.

Boeing said that there have been some delays in delivery of MAX engines but so far no airplane deliveries are late.

Flying hotter, tighter and harderAirlines today operate jet engines harder than ever before. They're built to tighter tolerances and operate at higher pressures and hotter temperatures.

They fly many more flights and much longer flights than in the past.

Boeing projects that the 2016 worldwide airliner fleet of 23,500 jets will double in the next two decades, swelling the number of engines in the sky.

But near term, the plans by Airbus and Boeing to hike A320neo, 737 MAX and 787 production significantly in the next two years cannot happen until the engine makers sort out their problems and ramp up production.

To deliver the reliability airlines demand on the narrowbody jets, Pratt & Whitney and CFM must hope no further teething pains develop.

Rolls-Royce faces a more existential crisis.

It's separately going through a drastic financial and corporate restructuring costing $670 million and on Thursday announced layoffs of 4,600 employees over the next two years.

A Rolls-Royce nightmare would be if the same blade-durability problems show up later on the remaining variants of the Trent engine: the newest version for the 787 the Trent TEN, or the Trent XWB for the Airbus A350, or the Trent 7000 for the Airbus A330neo.

To survive, Rolls-Royce needs to convince airlines soon that the Trent's technical problems are finally contained.

__________________________________________________________________________

• Dominic Gates has been The Seattle Times' aerospace reporter since 2003. Born in Northern Ireland, Gates moved to Seattle in 1992.www.seattletimes.com/business/boeing-aerospace/troublesome-advanced-engines-for-boeing-and-airbus-jets-disrupt-airlines-and-production-lines